Here are some of the incredible features and benefits TimeSolvPay offers:

- Next-day funding provides faster access to funds than traditional invoicing and paper check payments.

- No monthly, annual, industry, or hidden fees and guaranteed savings on credit card processing.

- Retainer replenishment and payments to trust.

- Ethically compliant functionality ensuring fees are deducted from the proper account.

- Increased collection rates and improved cash flow.

- Automation capabilities such as recurring billing and payment plans.

- Secure electronic presentment and payment options for invoicing.

- Convenient, contactless payment options for clients – they can even pay from their smartphone!

Users can sign up for TimeSolvPay directly from within the TimeSolv app. Head under Payments>Settings>TimeSolvPay tab. Check out our help articles for more information on how to get you set up!

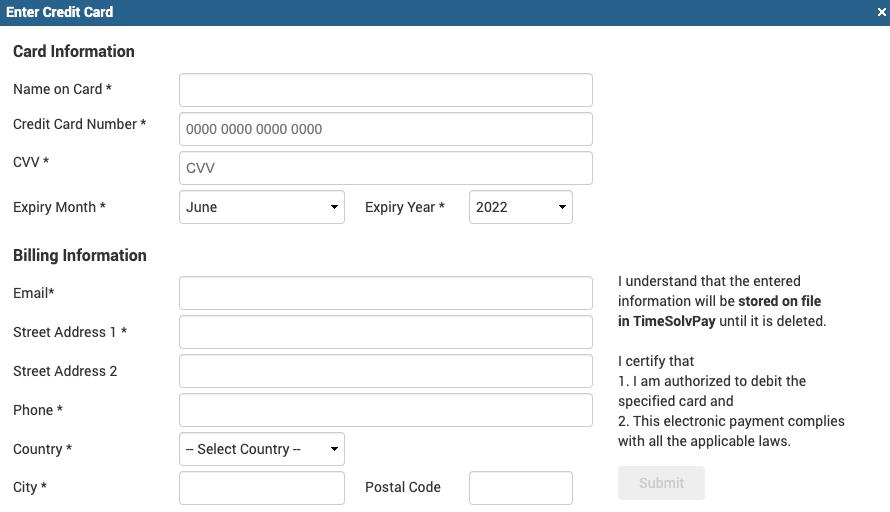

To store a payment method on file for a Client, click under either under Client Payment Settings or Matter Payment Settings. Navigate to Clients>Clients & Matters>Client/Matter>Payment Settings tab. Click on the ‘Enter Credit Card’ button to save your client’s payment information

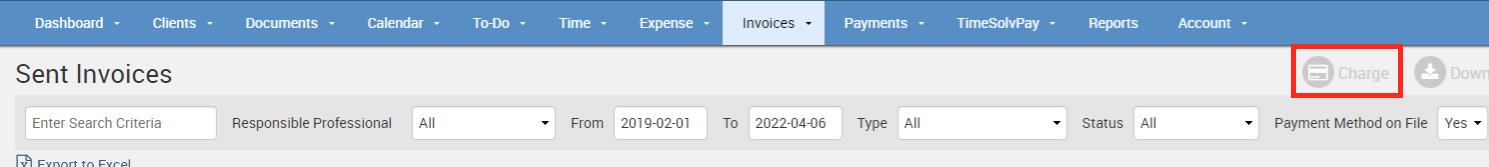

Once you have those payment details stored, the firm can navigate to Invoices>Sent screen and charge that credit card whenever needed. For example, if you select an invoice via the checkbox, and select the ‘Charge’ button on the top right side of the screen, the system will run a payment against the card on file.

The system will understand that it will only make a charge against those Clients & Matters that have a card or bank information on file. If they do not, it just gets passed over. So don’t worry if you want to just go ahead and ‘select all’ Invoices.

Once the payment is processed, the system will show the invoice as ‘Paid’ under the Sent Invoices screen, and an email will go out to the clients thanking them for their payment so that they know the payment has been run.

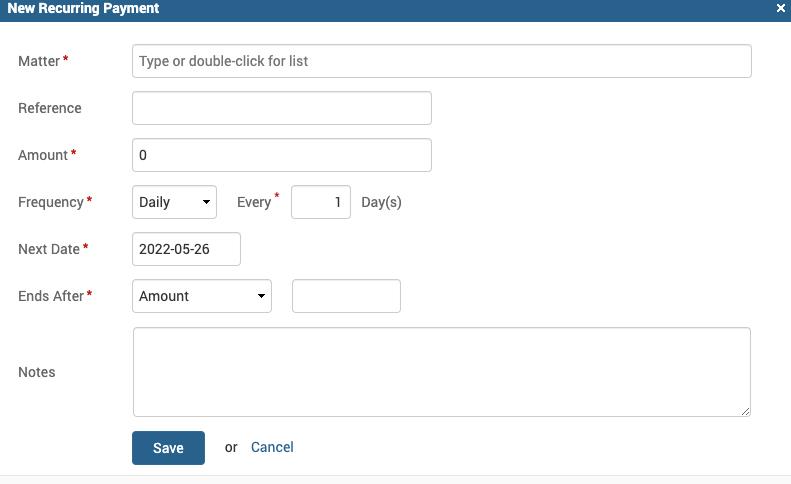

The firm can even set up recurring payments against a card/bank account by clicking under TimeSolvPay>Recurring Payments screen. These can be set up as daily, weekly, monthly, or annually. You can event set up the end time, which can be either by the amount collected, after X amount of charges, or after a certain date.

With all these customizations upon setting up a recurring payment, you don’t need to worry about it after it is set up, as TimeSolvPay and the TimeSolv system will take care of it all for you! This is an excellent way to set up payment plans with your clients.

Just make sure you write this information in your engagement letter before you start running payments using the details on file, so your clients have the heads up that you will be running payments against invoices. For example, you can inform them ahead of time: ‘We will send you your invoice, and you have X number of days to review your invoice, after which we will run the payment against your card on file’. This will avoid any unexpected disputes.

Our Zero AR method is a great way of making sure the firm is more in control of when they are getting paid as opposed to waiting and racking up their AR. With secure credit card and ACH processing built into TimeSolv, our users can spend more time practicing law, and less time chasing invoices. Make your cash flow worries disappear by running hundreds of payments on schedule with just a click of a button. What’s more, TimeSolvPay has a custom-built portal to easily track payments.

If you’d like to contact TimeSolv support for help, please call 1.800.715.1284 or contact support.